5 Steps to Achieving Financial Freedom: A Comprehensive Guide

Hey there! Are you tired of living paycheck to paycheck? Do you dream of a life where money isn’t a constant source of stress? Well, you’re in the right place! In this blog post, we’re going to dive deep into the topic of achieving financial freedom and give you a step-by-step guide to make it a reality. We understand the struggles and frustrations that come with trying to gain control over your finances, and we’re here to help you every step of the way. Let’s embark on this journey together and start building a better financial future!

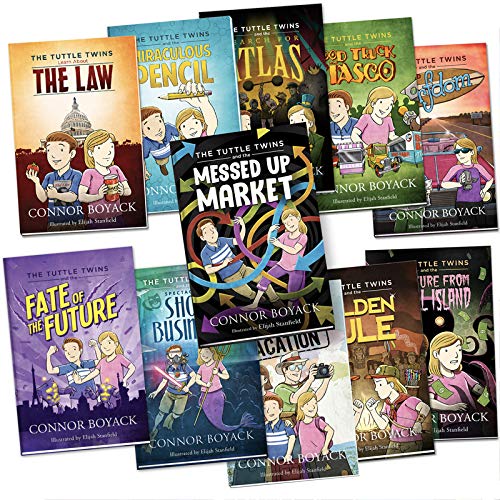

Unlock Your Path to Financial Success with These Bestselling Books

[content-egg-block modules=AmazonNoApi template=offers_grid cols=3 groups=”SectionIntro”]

Understanding Financial Freedom

When it comes to achieving our goals and living the life we desire, financial freedom plays a crucial role. But what does financial freedom actually mean? In this blog section, we will define financial freedom and explain why it is so important. We will also explore the benefits of achieving financial freedom and how it can positively impact various aspects of your life.

[content-egg-block modules=AmazonNoApi template=offers_grid cols=3 groups=”Section1″]

Defining Financial Freedom

Financial freedom refers to the state of having enough money and resources to live the life you want without being limited or controlled by financial constraints. It is the ability to make choices based on your desires and values rather than being forced to make decisions solely for financial reasons.

Breaking Free from Financial Stress

One of the key benefits of achieving financial freedom is the ability to break free from financial stress. When you have enough money to cover your basic needs and have a sense of financial security, you can focus on other important aspects of your life without constantly worrying about money. Financial freedom allows you to enjoy peace of mind and reduces the stress that comes with living paycheck to paycheck.

Pursuing Your Passions and Dreams

Financial freedom provides you with the opportunity to pursue your passions and dreams. Whether it’s starting your own business, traveling the world, or pursuing a new career, having the financial means to support your goals allows you to take risks and follow your aspirations. It opens up a world of possibilities and empowers you to live a life that is aligned with your true passions.

Building Wealth and Security

Achieving financial freedom often involves building wealth and long-term financial security. It allows you to accumulate assets, investments, and savings that can provide a safety net for unexpected expenses or emergencies. With financial freedom, you can plan for retirement, support your family, and leave a lasting legacy.

Independence and Control

Financial freedom gives you independence and control over your own life. You are not dependent on a paycheck or a job that you dislike simply to pay the bills. You have the freedom to choose how you spend your time and resources, whether it’s taking a sabbatical, starting a new venture, or investing in personal development. This level of control empowers you to live life on your own terms.

Key Steps towards Financial Freedom

While financial freedom may seem like an elusive goal, it is achievable with careful planning and disciplined actions. Here are some key steps to help you on your journey:

- Create a budget and track your expenses

- Pay off high-interest debts

- Save and invest consistently

- Diversify your income streams

- Educate yourself about personal finance and investment strategies

- Set clear financial goals and regularly review your progress

Setting Financial Goals

Setting clear financial goals is essential for achieving financial success. Without goals, it’s easy to lose track of your progress and make impulsive financial decisions. By setting goals, you give yourself a roadmap to follow and a sense of purpose when it comes to your finances. Here are a few reasons why setting financial goals is so important:

[content-egg-block modules=AmazonNoApi template=offers_grid cols=3 groups=”Section2″]

- Motivation: Setting financial goals gives you something to strive for and keeps you motivated to make smart financial choices. When you have a clear goal in mind, it becomes easier to resist unnecessary expenses and stay focused on your long-term financial well-being.

- Direction: Goals provide direction and help you make decisions that align with your financial aspirations. They serve as a guiding force, ensuring that you don’t get sidetracked by short-term temptations and instead focus on actions that will lead you closer to your ultimate objectives.

- Measure of Progress: Setting financial goals allows you to track your progress and measure your success. By regularly reviewing and reassessing your goals, you can see how far you’ve come and make adjustments if necessary. This helps you stay accountable and make any necessary adjustments to stay on track.

- Financial Security: Having clear financial goals helps you build a solid foundation for your future. Whether it’s saving for retirement, buying a home, or paying off debt, setting financial goals ensures that you’re taking steps towards long-term financial security.

How to Set Financial Goals Effectively

Now that we understand the importance of setting financial goals, let’s explore how to do so effectively. Here are some practical tips and strategies to help you identify your financial goals and create a plan to achieve them:

1. Define your goals

Start by identifying what you want to achieve financially. Whether it’s saving for a down payment, starting a business, or paying off student loans, be specific about what you want to accomplish. Write down your goals and make them measurable and realistic.

2. Prioritize your goals

Once you have a list of financial goals, prioritize them based on their importance and urgency. Some goals may require immediate attention, while others can be tackled over a longer period. Prioritizing allows you to focus your resources and efforts on the most critical goals first.

3. Break it down

Break your bigger goals into smaller, actionable steps. This makes them more manageable and helps you stay motivated along the way. Create a timeline and set milestones to track your progress. For example, if you want to save $10,000 for a down payment in two years, break it down into saving $416 per month.

4. Create a budget

A budget is essential in achieving your financial goals. It helps you track your income, expenses, and savings. By creating a budget, you can identify areas where you can cut back on expenses and allocate more funds towards your goals.

5. Automate savings

Make saving towards your goals effortless by automating your savings. Set up automatic transfers from your paycheck or checking account to a separate savings account dedicated to your goals. This way, you won’t have to rely on willpower alone to save consistently.

6. Regularly review and adjust

Review your financial goals regularly and make adjustments as needed. Life circumstances change, and your goals may need to be updated accordingly. Regularly tracking your progress and reassessing your goals ensures that you’re staying on the right path.

Benefits of Setting Financial Goals

Setting financial goals comes with several benefits. Here are some key advantages of having clear financial goals:

- Provides focus and direction for your financial decisions

- Motivates and encourages you to make smart financial choices

- Helps manage and reduce debt effectively

- Enables you to track your progress and celebrate milestones

- Increases financial security and prepares you for the future

By setting financial goals, you take control of your financial life and work towards a brighter and more secure future. So start setting your goals today and take the first step towards financial success!

Managing Your Finances: Key Principles for Effective Financial Management

Managing your finances is a crucial aspect of achieving financial security and stability. By adopting effective financial management practices, you can gain control over your money, make informed decisions, and work towards your financial goals. In this blog section, we will delve into the key principles of managing your finances and provide practical guidance on budgeting, saving, investing, reducing debt, and managing expenses.

[content-egg-block modules=AmazonNoApi template=offers_grid cols=3 groups=”Section3″]

1. Budgeting: Take Control of Your Money

Budgeting is the foundation of financial management. It allows you to track your income and expenses, prioritize your spending, and ensure you’re living within your means. Here’s how you can create and stick to a budget:

- Start by tracking your income and expenses: Use budgeting apps or spreadsheets to record your income sources and track your expenses.

- Categorize your expenses: Divide your expenses into categories such as housing, transportation, groceries, entertainment, and savings.

- Set financial goals: Identify short-term and long-term financial goals, such as saving for a down payment or paying off debt. Allocate a portion of your income towards achieving these goals.

- Monitor and adjust: Regularly review your budget, track your progress, and make adjustments as needed to ensure you’re staying on track.

2. Saving: Build a Safety Net

Saving money is essential to handle unexpected expenses, build an emergency fund, and work towards future goals. Here are some tips to help you save effectively:

- Pay yourself first: Set up automatic transfers from your paycheck to a separate savings account. Treat saving as a monthly expense to prioritize it.

- Create a rainy-day fund: Aim to save at least three to six months’ worth of living expenses in an emergency fund. This will provide a safety net during challenging times.

- Set up specific saving goals: Whether it’s for a vacation, home renovation, or retirement, having specific saving goals helps you stay motivated and focused.

- Explore high-interest savings accounts: Look for accounts that offer competitive interest rates to maximize the growth of your savings.

3. Investing: Grow Your Wealth

Investing can be an effective way to grow your wealth over time. Here are some key points to consider:

- Understand your risk tolerance: Assess your tolerance for market fluctuations and determine how much risk you’re willing to take on.

- Diversify your investments: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk.

- Consider your investment timeline: Determine your investment horizon, whether it’s short-term or long-term, and choose investments accordingly.

- Seek professional advice: If you’re new to investing, consider consulting with a financial advisor to help you make informed decisions.

4. Reducing Debt: Take Control of Your Financial Obligations

Debt can be a major obstacle to financial freedom. Here are some strategies to help you reduce and manage your debt effectively:

- Prioritize high-interest debt: Start by paying off debts with high-interest rates first, such as credit card debt.

- Consolidate your debt: Consider consolidating multiple debts into a single loan with a lower interest rate to simplify repayment and save on interest.

- Negotiate with creditors: If you’re struggling to make payments, reach out to your creditors to discuss alternative payment arrangements or negotiate lower interest rates.

- Create a repayment plan: Develop a realistic repayment plan, setting aside a portion of your income each month to tackle your debts systematically.

5. Managing Expenses: Make Every Dollar Count

Managing your expenses is crucial to maintaining a healthy financial life. Here are some tips to help you make the most of your money:

- Track your spending: Keep a record of every expense to identify areas where you can cut back or make adjustments.

- Differentiate between needs and wants: Prioritize your essential needs and be mindful of discretionary spending.

- Comparison shop: Research and compare prices before making significant purchases to ensure you’re getting the best value for your money.

- Automate bill payments: Setting up automatic bill payments can help you avoid late payment fees and ensure you stay on top of your financial obligations.

Managing your finances requires discipline, consistency, and a willingness to make informed decisions. By adopting these key principles and incorporating them into your daily life, you can take control of your finances, work towards your goals, and achieve financial well-being.

Remember, financial management is a journey, and each step you take brings you closer to a more secure and prosperous future.

Wrapping it up: Take control of your finances and pave the way to financial freedom

To sum it up, attaining financial freedom is within your reach if you are willing to put in the effort. By following these five steps – understanding, goal-setting, effective financial management, and exploring multiple income streams – you can make significant progress towards achieving your financial goals. Take action now and start implementing these strategies to improve your financial situation and enjoy the freedom and security you’ve always wanted.

Discover the Best Places to Purchase Your Path to Financial Freedom

[content-egg module=AmazonNoApi template=list keyword=”Financial Freedom->Secondary”]